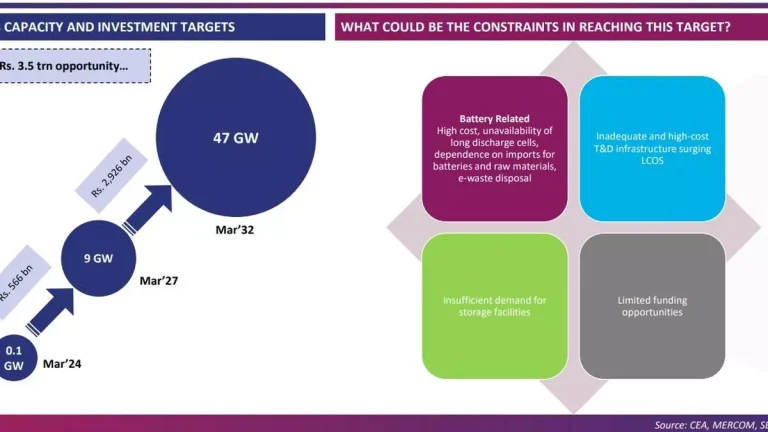

India’s battery energy storage system (BESS) ecosystem is on the cusp of unprecedented growth, with an estimated funding opportunity of ₹3.5 trillion by FY 2032. This growth is expected to be accelerated in the medium term by an additional ₹800 billion in investments, largely driven by capex in cell manufacturing, according to a report by SBI Capital Markets.

This massive opportunity covers both project level and upstream investments, supported by robust Power Purchase Agreements (PPA) and Power Sales Agreements (PSA) with credible DISCOMs, as well as project and tailor-made cellular technologies.

Obsolescence risks in BESS, such as falling battery prices and shifting to higher capacity batteries, are mitigated by competitive tariffs, DISCOM’s current targets for energy storage obligation ( ESO) and Renewable Purchase Obligation (RPO), as well as the lifespan of projects aligned with PPAs.

Increased battery manufacturing and M&A opportunities

Battery manufacturing will entail significant capital expenditure as established and emerging players expand. Technological advancements in this sector are also fueling an increase in mergers and acquisitions, providing lucrative opportunities for companies looking to expand.

The transition to a variable renewable energy (VRE) future is expected to triple the share of VRE generation by FY32. Storage capacity is expected to increase 12-fold, reaching 60 GW by FY32 , with the share of renewable energy tenders incorporating storage increasing from 5% in FY20 to 23% in FY24.

BESS and PSP as complementary technologies

BESS and pumped storage (PSP) projects are emerging as the leading energy storage solutions, and together are expected to capture almost 100% of the market. BESS will dominate with its flexibility, efficiency and fast response times, while PSP will serve as a complementary solution for peak shaving. Despite PSP’s longer gestation periods and associated challenges, its low operating costs, lack of e-waste, and network stabilization capabilities make it a valuable solution. BESS capacity is expected to reach 47 GW by FY32, with PSP increasing four-fold to 19 GW.

“Although current energy storage capacities are relatively modest, the sector is set to experience rapid growth over the next decade, with BESS emerging as the dominant technology and PSP playing a complementary role. A key driver of this expansion will be indigenization and a cradle-to-grave approach to the battery ecosystem, with the government’s PLI programs marking a crucial first step.

This will help further reduce tariffs, which are already at competitive levels, while promoting energy security. Together, these efforts could unlock an investment opportunity of over ₹5 trillion in this emerging sector, according to analysts at SBI Capital Markets.

Reducing BESS tariffs is dependent on domestic battery cell manufacturing and a robust component supply chain. Currently, 80% of BESS costs come from batteries and components, with most cell manufacturing concentrated in China.

- Also read: How discoms boosted renewable energy

Recognizing this, the government’s PLI for Advanced Cell Chemistry aims to build 55 GWh of new capacity, with major players already announcing almost 120 GWh, just enough to meet demand over the next few years. To meet this demand, further capacity expansions and a thriving component ecosystem (covering cathodes, anodes, electrolytes and separators) are expected.

Favorable policies, such as ISTS freight fee waiver and stringent ESO/RPO requirements, are expected to boost demand across the BESS value chain. This growth will strengthen BESS project development, cell manufacturing and component production, paving the way for solid expansion of the sector over the coming decade, the report notes.