Everett gas terminal near Boston expected to close in May due to extreme weather

Article content

(Bloomberg) — A natural gas terminal in operation for more than half a century provides crucial protection against power outages when bitter cold hits the northeastern United States. In less than five months, it is expected to close permanently.

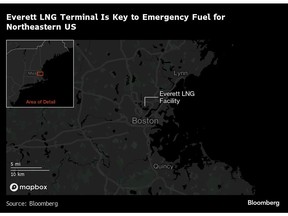

The Everett gas import plant near Boston is at risk of closing in May, coinciding with the retirement of its largest customer, the Mystic Power Plant. Both facilities are owned by Constellation Energy Corp., which has said operating Mystic is unprofitable under most conditions.

Advertisement 2

Article content

Article content

Closing Everett would jeopardize the reliability of the region’s power system during extreme weather, according to the nation’s top energy regulators. Because New England doesn’t have enough pipelines to deliver gas from other parts of the country, it relies on Everett when heating demand increases. The terminal receives cargoes of liquefied natural gas via tankers, mainly from Trinidad.

Read more: New York’s natural gas supply nearly cut off by 2022 Christmas storm

The facility’s closure underscores the challenges facing the U.S. grid as the transition to cleaner energy accelerates and climate change triggers more extreme weather. Although Mystic could eventually be replaced by wind farms and solar projects, it’s unclear whether those resources — and the battery storage needed to back them up — will be built quickly enough to avoid energy shortages.

“Everett was a key resource providing supplemental gas supplies to New England during periods of extreme cold,” said Gary Cunningham, director of market research at Tradition Energy, an energy risk management company.

Constellation is in negotiations for supply contracts that would allow it to keep Everett open, but nothing has been finalized and « time is of the essence, » said Mark Rodgers, a company spokesman. Meanwhile, the Federal Energy Regulatory Commission and the North American Electric Reliability Corporation are sounding the alarm.

Article content

Advertisement 3

Article content

“Ensuring reliability and affordability could become a challenge in the face of a significant winter event,” FERC Chairman Willie Phillips and NERC CEO James Robb said in a joint statement in November.

Even though this winter has been mild so far in the United States, that could be about to change. Weather models increasingly point to a cold snap across most of the country later this month, according to commercial forecaster Maxar Technologies Inc., as the Northeast prepares for its biggest snowstorm for over a year this weekend.

Gas is often seen as a transitional fuel as the world moves toward more environmentally friendly methods of producing electricity and heat. Everett’s closure is a sign of that shift, according to Greg Cunningham, vice president of clean energy and climate change at the Conservation Law Foundation, an environmental nonprofit.

“There will be climate-damaging fossil fuel-based facilities that will be decommissioned, and replaced by alternatives that public policies and markets have now chosen,” he said.

Advertisement 4

Article content

Analysis by grid operator ISO New England shows that at least for next winter, the region’s power system can withstand Everett’s withdrawal. Producers can obtain LNG from other suppliers, such as the Saint John LNG terminal in New Brunswick, Canada, or the Northeast Gateway facility off the coast of Massachusetts, the ISO spokeswoman said New England, Mary Cate Colapietro, in an emailed statement.

Nonetheless, the grid operator believes it would be prudent to keep Everett operating for the time being. The number of LNG import facilities in the region is limited, new infrastructure could face delays and there is uncertainty over increased electricity demand in winter as homes and businesses shut down. will convert to electricity from gas, Colapietro said.

Long-term planning for gas demand depends on whether Massachusetts succeeds in its efforts to reduce the fuel’s use for home heating over the next decade, Gary Cunningham said.

“If these programs work, the need for the LNG terminal should decrease significantly, but simply relying on the reduction in demand over the last year when the weather was absurdly mild is not the way to go.” indicator to measure success,” he said.

—With assistance from Brian K Sullivan.

Article content