Fears of a systemic credit event are growing among fund managers as alarms sound across property markets around the world.

Article content

(Bloomberg) — Fears of a systemic credit event are growing among fund managers as alarms sound in real estate markets around the world.

About one in six respondents consider such a crisis to be the most significant tail risk facing markets, up from about one in 11 in December, according to Bank of America Corp.’s latest Global Fund Manager survey. Growing concern over the U.S. commercial real estate markets and Chinese real estate markets now makes it the third-largest concern among respondents, behind inflation and geopolitics.

Advertisement 2

Article content

Article content

Hopes that the Federal Reserve would cut interest rates and ease some of the pressure on housing were dented by higher-than-expected inflation figures this week. Traders are now betting on cuts of less than 90 basis points this year, almost half of what was expected in January. Meanwhile, more than $900 billion of U.S. commercial and multifamily real estate debt will require refinancing or property sales this year – a 40% jump from a previous estimate – after banks granted loans, among other factors, and as property values fall.

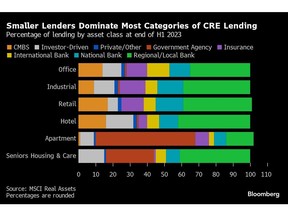

Smaller banks appear to be on a trajectory toward 8% to 10% default rates in their CRE loan portfolios, Bruce Richards, president of Marathon Asset Management, warned in a LinkedIn post this week. These lenders are particularly vulnerable to the CRE slowdown after increasing their exposure in recent years. In contrast, the big banks “are as strong as the Rock of Gibraltar,” Richards said by telephone.

A 10% default rate on CRE loans would result in about $80 billion in additional bank losses, according to a study on the fragility of U.S. banks released in December. The document warns that CRE’s difficulties could expose more than 300 mainly small regional banks to the risk of a solvency crisis.

Article content

Advertisement 3

Article content

“We will continue to see increasing levels of distress,” said Omar Eltorai, research director at data provider Altus Group. “It’s one of those variables that people can call in early, but there’s a certain amount of time before it shows up,” he said, adding that it can sometimes be measured in years.

Click here to read an article on the CRE debt crisis

For now, the Fed is coordinating with lenders with concentrated exposure to CRE on a plan to overcome expected losses. Although the losses are concerning, U.S. regulators are trying to ensure that loan loss reserves and liquidity levels are sufficient to cope, Treasury Secretary Janet Yellen said earlier this month.

Yet according to the BofA survey, nearly 40% of fund managers view U.S. business formation as the most likely source of a credit event, and another 22% view Chinese real estate as the most likely. great threat. The survey took place Feb. 2-8, just days after New York Community Bancorp cut its dividends and built reserves, in part because of weakness in the office and multifamily housing markets.

Read more: NYCB talks with Watchdog led to moves that shook the market

Advertisement 4

Article content

The turmoil has since spread to German lenders exposed to American CRE. Bonds of Deutsche Pfandbriefbank AG fell further into distress territory on Thursday after S&P Global Ratings downgraded the bank’s rating, citing its heavy exposure to the beleaguered market.

Click here to listen to a podcast about Fidelity’s concerns about creditor violence

Review of the week

- The wave of money flowing into the credit market acts as a shield for investors against any downside scenarios – even the prospect of ever-deeper central bank cuts this year.

- U.S. banks are starting to increase their purchases of everything from mortgage-backed securities to collateralized loan obligations, after nearly two years of reductions.

- An insurance product that consumers use to fund their retirement is selling at record levels, fueling demand for corporate debt and commercial mortgage bonds.

- Insatiable demand for investment grade bonds in the United States is causing investors to shrug off any jitters over New York Community Bancorp’s risky exposure to real estate.

- JPMorgan Chase & Co. beat private lenders by providing about $2.5 billion in debt financing to support Cohesity Inc.’s proposed acquisition of a unit of Veritas Technologies.

- Logan Group Co. bought more time to implement its debt restructuring plan, after a Hong Kong court rejected requests from creditors to liquidate the Chinese developer’s two key units.

- Redsun Properties Group Ltd., another Chinese developer, received a liquidation petition in a Hong Kong court filed by Bank of New York Mellon.

- Bonds of China South City Holdings Ltd. fell at a record pace after the automaker defaulted on a dollar bond for the first time, reflecting new concerns over the extent of government support for the struggling sector.

- Bristol Myers Squibb sold $13 billion in bonds to help finance its acquisitions of Karuna Therapeutics Inc. and RayzeBio Inc., in a deal that raised orders exceeding $85 billion.

- Siemens AG sold Europe’s largest corporate bond offering in a year, following an upgrade in its credit rating.

- A group of banks has launched a $5 billion leveraged loan sale to help finance KKR & Co.’s purchase of a stake in Cotiviti Inc.

Advertisement 5

Article content

Moving

- Citigroup Inc. has hired JPMorgan Chase & Co. veteran John Witherspoon as a managing director of its real estate investment banking team.

- Alberta Investment Management Corp., one of Canada’s largest pension plans, is opening an office in New York as part of its private credit investment efforts.

- Newmark Group Inc. has recruited Matthew Featherstone to lead its debt and structured finance businesses for the UK and Europe.

- S&P Global Ratings has hired David Knutson, former senior investment director at Schroders Plc, to succeed Gerard Painter who is expected to retire at the end of the month.

Article content