(Bloomberg) — Chinese stocks appear poised for a strong open as domestic traders return from the Lunar New Year holiday, with buoyant travel and tourism data bringing much-needed relief to one of the world’s most important markets. least efficient in the world.

Most read on Bloomberg

With trading in mainland China closed from February 9 to 16, investors will likely take inspiration from the gains seen in the country’s stocks listed abroad. Hong Kong’s stock index has risen nearly 5% since reopening on Wednesday, while the Nasdaq Golden Dragon China index jumped 4.3% for the week, underscoring the chance for domestic stocks to catch up. delay.

Read more: Manufacturers lead Hong Kong stock rally on increased financial support

Spending patterns during one of China’s most important holidays suggest consumption has picked up even as the broader economy grapples with deflation and a housing crisis. Market watchers expect the flow of positive data to give stocks a boost, at least in the short term, aiding authorities’ efforts to revive investor confidence. A big question remains, however, about the sustainability of a possible rebound in the face of more serious economic difficulties.

“Early Chinese New Year data, from holiday hotel sales to visitation numbers to Macau, highlight positives in service-related sectors,” said Linda Lam, head of equity advisory for North Asia to Union Bancaire Privée. “A shares are expected to open on a stronger note, continuing the stock price recovery on the back of state support,” she said, referring to mainland-traded Chinese stocks.

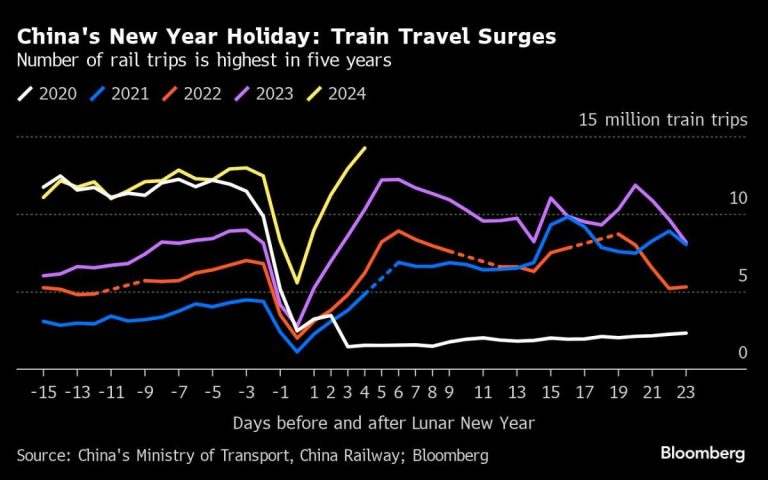

Some Chinese stocks in Hong Kong jumped in response to holiday data showing a 61% increase in train travel from the previous year, when the country faced a widespread Covid outbreak. Online hotel bookings and delivery spending at giant Meituan also saw considerable gains.

Macau reported more than 1 million visitors in the first six days of the holiday – the highest since 2017, when daily peak season data became available – with mainland tourists accounting for 77% of the total.

Read more: Rise in China Holiday Travel Points to a Recovery in Consumer Spending

China Tourism Group Duty Free Corp. surged more than 15% in the three post-holiday sessions in Hong Kong, while travel platform Trip.com Group Ltd. added 7%. Meituan and e-commerce player JD.com Inc gained more than 10% each.

Options data suggests traders are becoming more bullish. The Hang Seng China Enterprises Index’s 25-day delta skew, which measures the difference between investor demand for puts and calls, is now in favor of calls for contracts that expire in March.

Authorities sought to stem the rout in stocks ahead of the holiday, with public funds boosting purchases, a series of regulatory tweaks to reduce selling pressure and a surprise replacement of the head of the securities regulator . The moves helped the benchmark CSI 300 index rebound from a five-year low and climb 5.8% in the week leading up to the holiday.

The continued recovery would be crucial for the world’s second-largest market, which has fallen out of favor with investors after several years of losses. Global fund managers have pulled out of Chinese stocks as geopolitical tensions and Beijing’s expansive control over the private sector bog down the country’s tech giants.

Traders are pinning their hopes on additional policy support in the monetary and fiscal space, in addition to a reduction in the reserve requirement ratio. Any signs of recovery appearing before the key annual meetings in March, where leaders will announce the economic growth target and development goals, will be closely watched.

China’s central bank maintained its key interest rate on Sunday to protect the yuan from significant fluctuations, while assessing the impact of recent support measures.

The People’s Bank of China kept its one-year policy lending rate unchanged at 2.5%, as expected by most economists surveyed by Bloomberg.

Read more: China set to wait for rate cut until yuan and data stabilize

“Funds that were lightly positioned before the holiday could be more proactive in adding A-shares now that the setup is more favorable – with better liquidity after the RRR reduction, a new head at the China Securities Regulatory Commission and strong consumption of the New Lunar. Holiday year,” said Shen Meng, director of Chanson & Co in Beijing.

The CSI 300 gauge has lost more than 40% of its value since a peak in 2021, hammered by the country’s strict Covid controls, regulatory crackdown, an uneven economic recovery as well as geopolitical tensions.

Beyond a likely short-term rebound, doubts remain deep about the market’s longer-term prospects. Bank of America Corp.’s latest investigation among global fund managers showed that short selling in Chinese stocks, which has been the second busiest market for months, is becoming increasingly popular. A third of respondents said they would increase their allocation if they considered more aggressive fiscal policy to boost the real estate sector.

“In the short term, national team purchases will remain the key factor supporting the Chinese market,” said Daisy Li, fund manager at EFG Asset Management. “Over the next three to six months, it will depend on what target China sets for economic growth and budget deficit for this year.”

Read more: Xi can’t use 2015 playbook to calm Chinese markets, investors say

–With help from Akshay Chinchalkar, Tom Hancock, James Mayger and Adam Majendie.

(Adds central bank rate decision in paragraphs 12 and 13.)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP