Asian stocks are expected to end the week strong, with Taiwan Semiconductor Manufacturing Co.’s outlook fueling hopes for a global technology recovery this year.

Article content

(Bloomberg) — Asian stocks are expected to end the week strong, with Taiwan Semiconductor Manufacturing Co.’s outlook fueling hopes for a global technology recovery this year.

Australian stocks rallied and stock futures in Japan and Hong Kong pointed to early gains after US stocks ended a two-day losing streak following easing bond market volatility . U.S. stock contracts were little changed in Asian trading after the tech-heavy Nasdaq 100 index closed at a record high as TSMC profits sparked the chipmakers’ strongest rally in more than ‘a month.

Advertisement 2

Article content

Article content

The main chip supplier to Apple Inc. and Nvidia Corp. said it expects a return to solid growth this quarter as it continues plans for factories in Japan, Arizona and Germany. Stocks such as Philadelphia’s semiconductor index gained 3.4%.

“Tech stocks could continue to rebound until the release of October-December financial results, driven by TSMC’s growth outlook for the year and strong demand for generative AI,” said Nobuhiko Kuramochi, strategist market at Mizuho Securities.

Stock traders generally were unfazed by data highlighting the strength of the U.S. labor market at a time when Fed officials are looking for signs of a slowdown as they consider rate cuts . Atlanta Fed Bank President Raphael Bostic urged policymakers to proceed with caution given the potential impacts of unpredictable events, from elections to global conflicts. His Philadelphia counterpart, Patrick Harker, said he expects inflation to continue falling toward the target.

Article content

Advertisement 3

Article content

The dollar and monetary policy-sensitive two-year Treasury yields were steady Thursday as investors took a breather after this week’s frenzied reassessment of the Fed’s policy outlook. Traders see the prospect of a March rate cut as little more than a coin toss, down from nearly 80% late last week after the Fed’s hawkish speech and data indicating that the American consumer remains resilient.

“Given the underlying strength of the U.S. economy, it’s hard to be too bearish at this point,” said Chris Zaccarelli of Independent Advisor Alliance. “The pervasive pessimism and doubt about the stock market and the economy is a contrarian signal and one of the best reasons to lobby against the mob. Once the last skeptic is converted, the market will again be vulnerable to a significant shock, but we are not there yet.”

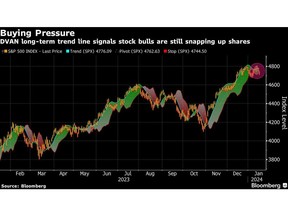

After enjoying its best winning streak in two decades, the S&P 500 hit a roadblock in 2024, with its all-time closing record set two years ago remaining elusive. But a technical indicator that measures stock buying or selling momentum signals that bulls continue to move in to acquire shares.

Advertisement 4

Article content

The index’s DVAN trendline – a proprietary divergence analysis that measures buying or selling pressure – has been on a buying streak since the S&P 500 hit its lowest level in late October, the investors continuing to acquire shares over several trading sessions before the October closing bell. last week.

“There is clearly a desperate desire to cling to the optimism that has led to such a strong end to the year, but unlike this period the data isn’t really playing into the equation,” said Oanda’s Craig Erlam . “The releases we’ve seen so far this month have been good and, overall, right in line with people’s expectations heading into 2024. But is it enough?”

Elsewhere, oil traded around $74 a barrel, supported by geopolitical risks as the United States struck more than a dozen Houthi missiles in Yemen. Gold has changed little.

Company strengths:

- Preliminary results from Humana Inc. missed estimates on higher-than-expected costs of member care and the Medicare-focused insurer projects anemic enrollment growth for this year.

- Boeing Co. won an order for 150 Max jets from India’s new airline, a rare bit of good news for the U.S. planemaker since a piece of fuselage exploded on an Alaska Airlines flight nearly two years ago weeks.

- Nelson Peltz said Walt Disney Co. was unable to heal its « self-inflicted wounds » under its current leadership and should aim for « Netflix-like margins, » days after the entertainment giant rejected the activist’s candidacy for a seat on its board of directors.

- Bayer AG opposes breaking up the conglomerate, rejecting calls from investors frustrated by the company’s continued struggle to recover from its costly purchase of Monsanto, according to people familiar with the matter.

- Birkenstock Holding Plc’s growth targets have failed to satisfy traders who were hoping for more from the German sandal maker.

- KeyCorp reported fourth-quarter profit below analyst estimates and predicted a decline in net interest income this year.

- Goodyear Tire & Rubber Co. named Stellantis NV executive Mark Stewart as CEO following a pressure campaign by shareholder activist Elliott Investment Management.

- Discover Financial Services reported a 62% drop in fourth-quarter profit as the company continued to grapple with the fallout from compliance and risk management failures that led to the resignation of its CEO last year.

Advertisement 5

Article content

Key events this week:

- Retail sales in Canada, Friday

- Japan CPI, tertiary index, Friday

- U.S. Existing Home Sales, University of Michigan Consumer Sentiment, Friday

- ECB President Christine Lagarde and IMF Managing Director Kristalina Georgieva speak in Davos on Friday.

- San Francisco Fed President Mary Daly speaks Friday

Actions

- S&P 500 futures were unchanged as of 8:40 a.m. Tokyo time

- Hang Seng futures rose 0.1%

- Australia’s S&P/ASX 200 rose 1.2%

- Nikkei 225 futures rose 1.3%

Currencies

- Bloomberg Dollar Spot Index little changed

- The euro remained unchanged at $1.0876

- The Japanese yen was little changed at 148.14 per dollar.

- The offshore yuan was little changed at 7.2163 per dollar.

- The Australian dollar was little changed at $0.6578.

Cryptocurrencies

- Bitcoin rose 0.4% to $41,253.03

- Ether rose 0.5% to $2,466.2

Obligations

- The 10-year Treasury yield rose four basis points to 4.14%

- The Japanese 10-year yield rose five basis points to 0.650%

- The Australian 10-year yield rose five basis points to 4.32%

Raw materials

- West Texas Intermediate crude was little changed

- Spot gold little changed

This story was produced with the help of Bloomberg Automation.

—With help from Rita Nazareth and Winnie Hsu.

Article content