Stocks in Asia are expected to rise as a further slowdown in the U.S. labor market has heightened speculation that the Federal Reserve may be able to cut interest rates next year to avoid a recession, prompting Treasurys to resume their rally.

Article content

(Bloomberg) — Stocks in Asia are expected to rise as a further slowdown in the U.S. labor market has heightened speculation that the Federal Reserve may be able to cut interest rates next year to avoid a recession, prompting Treasury bonds to resume their rally.

The benchmark Australian shares rose and futures pointed to gains in Japan and Hong Kong after the S&P 500 closed, with little change. Benchmark U.S. 10-year yields that briefly topped 5% in October fell below 4.2% on Tuesday, following data showing job openings hit their lowest level since 2021. Bonds Australian stocks jumped at the start of the session.

Advertisement 2

Article content

Article content

The Job Openings and Labor Turnover Survey – known as JOLTS – lags behind all estimates in a Bloomberg survey of economists. The data came days before the key jobs report, which is currently expected to show employers created 187,000 jobs in November.

« Overall, the employment update is in the driver’s seat, » said Ian Lyngen of BMO Capital Markets. “Treasuries extended the upward price action. From there, there won’t be much on the macro horizon until tomorrow’s ADP report.”

In China, the benchmark CSI 300 index fell nearly 2% on Tuesday to close at its lowest level since February 2019, after Moody’s Investors Service downgraded its outlook for the country’s sovereign bonds to negative. Futures point to further losses on Wednesday.

Treasuries also followed gains in global bonds after one of the European Central Bank’s most hawkish officials said inflation was showing a « remarkable » slowdown. That led investors to bet that Europe would lead the world’s biggest central banks in lowering interest rates. Crude fell for a fifth day on Wednesday while Bitcoin rose for a seventh day to trade above $44,000.

Article content

Advertisement 3

Article content

Swap contracts that anticipate the outcome of Fed meetings have slightly increased the amount of easing they anticipate by the end of 2024, with the effective federal funds rate expected to fall to around 4.05% from 5. 33% currently.

Read: El-Erian says Fed risks losing control of its messaging on US rates

To move back

BlackRock Inc. says market optimism about the size of rate cuts next year could go too far and recommends pulling out of longer-dated bonds.

“We see the risk that these hopes will be dashed,” wrote strategists including Wei Li and Alex Brazier. “Higher rates and greater volatility define the new regime. »

Read: Wall Street CEOs head to Washington to voice concerns about capital rule

At the same time, the cost of purchasing protection against currency fluctuations is rising as traders prepare for a slew of data and central bank meetings that could shed light on the timing of a possible pivot towards rate cuts next year.

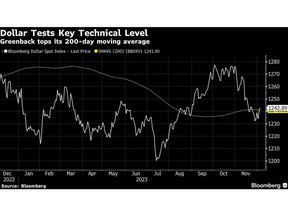

The greenback’s Bloomberg gauge rose for a second session Tuesday, while the Australian dollar led losses among its G-10 peers after a less-than-hawkish statement from the Royal Bank of Australia. The Japanese yen outperformed its peers.

Advertisement 4

Article content

In other markets, spot gold fell further after hitting an all-time high on Monday. Benchmark U.S. crude futures fell to a fresh five-month low as traders remained unconvinced that new OPEC+ export curbs will significantly tighten the market.

Key events this week:

- Eurozone retail sales, Wednesday

- Factory orders in Germany, Wednesday

- ADP private jobs in the United States, trade balance, Wednesday

- The CEOs of Wall Street’s biggest banks, including JPMorgan, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America, are expected to testify on regulatory oversight before the Senate Banking Committee on Wednesday.

- Bank of Canada monetary policy meeting, Wednesday

- Bank of England publishes biannual report on the stability of the UK financial system, holds press conference on Wednesday

- Chinese trade and foreign exchange reserves, Thursday

- Eurozone GDP, Thursday

- German industrial production, Thursday

- US wholesale stocks and first jobless claims, Thursday

- German CPI, Friday

- Japanese household spending, GDP, Friday

- Andrea Brischetto, head of financial stability at the Reserve Bank of Australia, speaks at the Banking and Financial Stability Conference in Sydney on Friday.

- U.S. jobs report, University of Michigan consumer sentiment, Friday

Advertisement 5

Article content

Some of the main market movements:

Actions

- S&P 500 futures were little changed as of 8:27 a.m. Tokyo time. The S&P 500 was little changed.

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.2%

- Australia’s S&P/ASX 200 rose 0.5%

- Hang Seng futures rose 0.2%

- Nikkei 225 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0793

- The Japanese yen was little changed at 147.17 per dollar.

- The offshore yuan was little changed at 7.1728 per dollar.

- The Australian dollar was unchanged at $0.6552

Cryptocurrencies

- Bitcoin rose 0.4% to $44,074.78

- Ether rose 0.6% to $2,287.5

Obligations

- The Australian 10-year yield fell 12 basis points to 4.29%

Raw materials

- West Texas Intermediate crude fell 0.2% to $72.14 a barrel

- Spot gold little changed

This story was produced with the help of Bloomberg Automation.

—With the help of Rita Nazareth.

Article content