Here are the takeaways from today’s Morning Brief, which you can register to receive every morning in your mailbox accompanied by:

This was going to be a column on whether you should buy a Bitcoin ETF for cash.

It will always be like this. But first we need to shake off the 2020s madness that has transpired around product approval.

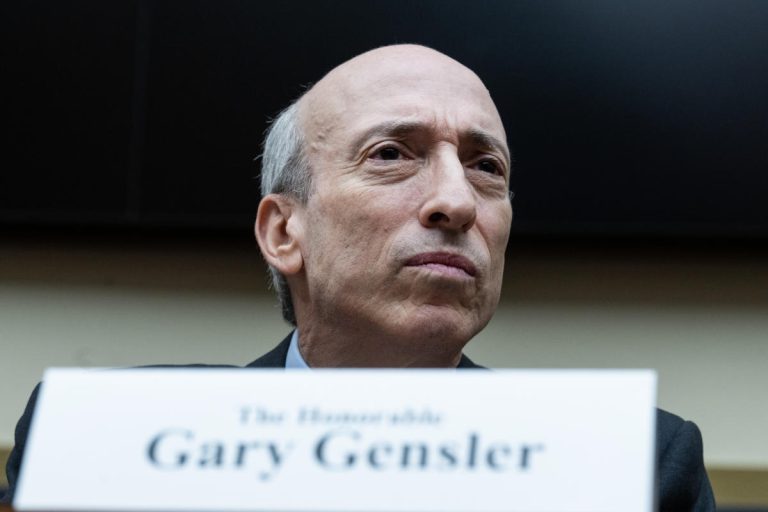

As you may already know, if you have been following the news on the highly anticipated bitcoin spot ETFs, yesterday afternoon the official Securities and Exchange account on X (fka Twitter) posted that the products had been approved. This tweet was followed, about 15 minutes later, by a message from SEC Chairman Gary Gensler, claiming that the other account had been compromised and that the approval had in fact not occurred. Bitcoin Prices whirled wildly between these two statements, first rising and then plunging.

This swing was reflected on our guest’s face. live video, Samir Kerbage, chief investment officer of Hashdex, one of the ETF issuers seeking SEC approval. Kerbage’s wide smile turned into a sadder smile as the situation evolved.

This is an unfortunate situation that fuels the SEC’s enemies within the crypto community. (Anthony Scaramucci jobwithout proof, “I think Gensler is lying. « )

It also does a disservice to those trying to legitimize and broaden Bitcoin’s appeal. Even if it was a mistake on the part of the SEC, even if it was a hack of some sort, if you’re a retail investor, is this just another sign of the circus that surrounds cryptocurrency?

Meanwhile, if everything still goes according to plan, the ETFs could still be approved later today and begin trading tomorrow, as reported by my colleague David Hollerith.

So should you buy it?

So forget about roller coasters for a moment. Let’s move on to the real question for investors: should you actually buy one (or more) of these things?

I interviewed a handful of strategists and traders, both fans of Bitcoin and not, and came up with some useful guidelines for retail investors.

The first question is whether you are interested in Bitcoin as an underlying asset: « If you weren’t sold on BTC as a portfolio asset yesterday, launching an ETF shouldn’t make a difference » , underlines Dave Nadig, financial futurist at VettaFi.

Steve Sosnick, chief strategist at Interactive Brokers, echoes this sentiment and recalls previous FOMO-driven periods for crypto and other assets.

“If your primary motivation is just that everyone is talking about it, that’s a terrible reason. Sure, you can sometimes make money just by following the herd in the short term, but this strategy rarely works in the long term. (Sosnick will appear on Yahoo Finance Live at 10 a.m. ET today).

Bitcoin bull Tom Lee of Fundstrat has long touted the cryptocurrency’s appeal. He also likes the ETF wrapper for retail investors: “A Spot Bitcoin ETF is one of the easiest ways for an investor to gain exposure to Bitcoin. And easier than buying it on a crypto exchange,” he said in an email. That said, he warns that bitcoin remains “hyper volatile,” whether one invests through an ETF or in the underlying crypto.

Then comes the question of how much of your portfolio to allocate to Bitcoin. Lee says 2%. Nadig says “a lot of people settle” for the 1% to 3% range.

Matt Tuttle of Tuttle Capital Management, an « ETF guy » who has filed for approval for a 2x leveraged Bitcoin ETF, puts the number a bit higher. “I would look at bitcoin the same way you look at other ‘alternative’ investments, so for the most part it’s 5-10%,” he said.

And Sosnick has a simple rule: « No more than you can afford to lose without regret. » »

Finally, what product(s) should investors buy?

“All things being equal, cheaper is better,” Tuttle said, a sentiment widely shared. Strategists also said criteria such as liquidity and who is the custodian of the underlying assets could be important (for most ETFs, this is Coinbase).

The SEC itself has offered guidance in previous essay yesterday: “If you choose to purchase digital currencies or tokens, recognize that they are new. There can be significant risk in investing your money in something that hasn’t been around for very long. A good rule of thumb when investing in a new product is to only invest the money you are willing to lose, so that it is not financially devastating if the investment does not pan out,” wrote Lori Schock, director of investor and agency education. Advocacy.

This message, at least, seemed legitimate.

Click here for in-depth analysis of the latest stock market news and events that move stock prices..

Read the latest financial and business news from Yahoo Finance