(Bloomberg) — Investors are optimistic about the chances of further gains in shares of Nvidia Corp.’s main memory supplier, SK Hynix Inc., which remain cheap even after a huge rally.

Most read on Bloomberg

Shares of the South Korean company have surged 96% since the start of last year, far outpacing memory rivals Samsung Electronics Co. and Micron Technology Inc. Yet its shares still trade at just 11 times forecast profits, compared to 15 for Samsung and 30 for Micron. and 27 times for the Philadelphia Semiconductor Index.

The bottom line is that SK Hynix was able to get a head start on the competition in the high-bandwidth memory (HBM) market, capable of delivering the large volumes of data at the high speed required by AI. That helped it attract more investor attention after years of playing No. 2 behind Samsung.

“It is too risky not to hold SK Hynix in the portfolio,” said Yoon Joonwon, fund manager at DS Asset Management Co. “As major global technology companies record further gains, investors also expect more upside for SK Hynix. »

HBM has a DRAM stack optimized to work alongside accelerators, processors widely used in AI training. Not subject to the cyclical demand and prices of traditional commoditized memory, HBM chips are much more lucrative.

High-priced AI products helped SK Hynix post an operating profit for the quarter ended December, following four consecutive quarterly losses.

HBM Manager

The company seeks to maintain its lead over Samsung and Micron in AI. To this end, SK Hynix has reportedly partnered with major foundry Taiwan Semiconductor Manufacturing Co. to develop its next-generation HBM chip. SK Hynix declined to comment on the report, while TSMC did not respond to Bloomberg’s inquiries.

The news « triggers market speculation that SK Hynix would be a clear winner in the HBM space » and reflects strong demand for its products, JPMorgan Chase & Co. analyst Jay Kwon wrote in a research note this week. “We expect the strong momentum in stocks to continue in the near term.”

Kwon is one of 40 analysts who have a buy-equivalent rating on the stock, with just three hold recommendations and no sells. The average sell-side price target indicates an expected return of 20% over the next 12 months.

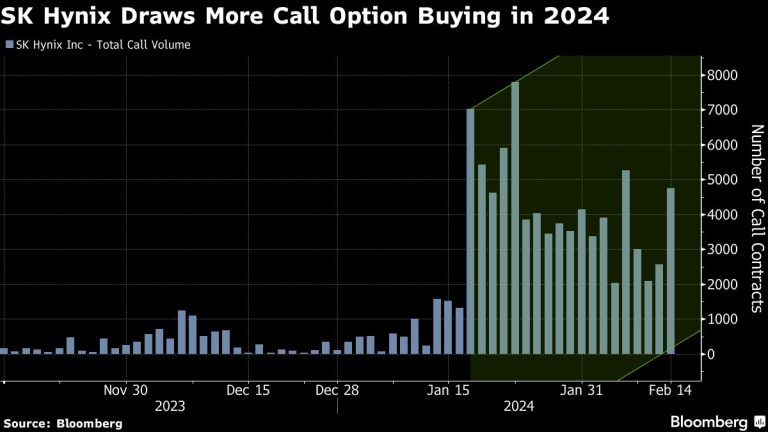

Options traders are also optimistic, with average daily call volume this year up more than 57% from last year, according to Bloomberg calculations. The most popular contract traded Thursday was a bet that the stock would rise another 4% by mid-March.

Upcoming catalysts include Nvidia’s February 21 earnings report, which is expected to provide more detail on the outlook for AI. Investors will also keep an eye on news of new partnerships or competitors’ progress for any early signs of leadership changes in this growing field.

“Benefiting from a big competitive advantage in HBM, SK Hynix could capture a significant market share in the DRAM industry,” Masahiro Wakasugi, an analyst at Bloomberg Intelligence, wrote in a note. “Its dominance over HBM DRAM is poised to persist in the near term, given its deep relationships with AI processor designers.”

Most important technology news

-

Apple Inc., which is working to add more artificial intelligence capabilities, is close to completing a critical new software tool for app developers that would boost competition with Microsoft Corp.

-

Microsoft Corp. will offer four exclusive Xbox games for Nintendo Co.’s Switch and Sony Group Corp.’s PlayStation, sharing local titles with rivals in the first significant way as the company seeks to boost revenue in a stagnant gaming market.

-

Applied Materials Inc., the largest U.S. maker of chipmaking machines, jumped in late trading after giving bullish revenue forecasts for the current period, signaling that some of the biggest semiconductor companies are increasing their investments in new production.

–With help from Jane Lanhee Lee.

(Updates share data as of Friday’s close in Seoul)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP