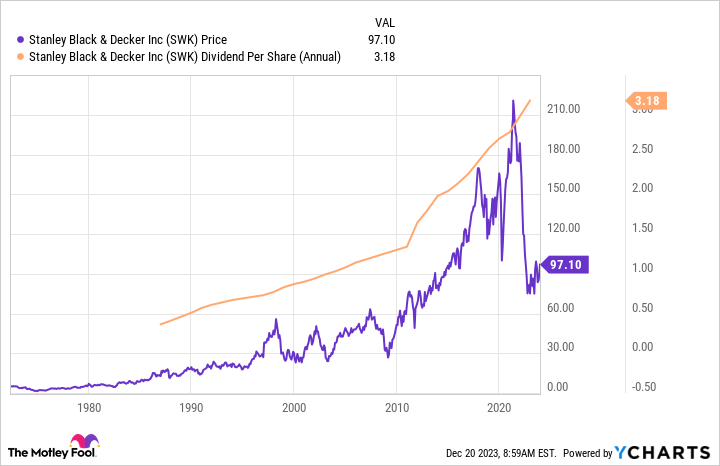

Actions of Stanley Black & Decker (NYSE:SWK) are down about 50% from their 2021 highs. There are very good reasons for this, as you’ll learn below. But the company expects an incredible earnings improvement in 2024. Assuming it can live up to those forecasts, the stock could also see a strong rebound. Here’s what you need to know.

Stanley Black & Decker dropped the ball

During the coronavirus pandemic, demand for tools produced by Stanley Black & Decker was quite high. It makes sense: People stuck at home have taken on home improvement projects to improve their living experience. Adjusted earnings in 2021 increased 30% from 2020 and reached a record $10.48 per share. At the start of 2022, the company forecast adjusted annual earnings of between $12.00 and $12.50 per share, which would have been another record result.

It didn’t go exactly as planned. Instead, Stanley Black & Decker posted adjusted earnings of $4.62 per share. This represents a drop of more than 50%. It’s not hard to see why investors might have found this upsetting after the company set much higher expectations. Things have only gotten worse in 2023, with management now expecting full-year adjusted earnings to be between $1.10 and $1.40 per share. This would represent a further considerable decline and would help explain the malaise in stock prices.

The story of this weak performance is equally troubling. High leverage, slowing sales and low margins are all contributing factors. But Stanley Black & Decker has been working to get back on track, including reducing leverage, cutting costs and raising prices. The improvements are already starting to show in the company’s bottom line.

Stanley Black & Decker improves quarter after quarter

Stanley Black & Decker is a industrial giant and you can’t turn a ship like this around in no time. It takes time, but slow and steady progress is clearly visible. For example, the company’s adjusted amount Gross margin has increased every quarter since hitting a low point in Q4 2022. The improvement is also huge, with adjusted gross margin increasing from around 20% to 28%.

Meanwhile, the King of dividends (it has increased its dividend for 56 consecutive years) entered 2023 expecting adjusted earnings of between zero and $2.00 per share. This amount has been reduced to $1.10 to $1.40 per share, indicating that the worst-case scenario is not even close to being realized. Sure, the high end was lowered, but the real risk for investors was that the low end of the business would collapse, and that just didn’t happen.

Meanwhile, through 2024, Stanley Black & Decker reiterated its previous forecast of adjusted earnings of between $4.00 and $5.00 per share. This was a target used to justify the company’s turnaround plans. So it would be reasonable to expect management to be aggressive. But the company is well engaged in this recovery plan and continues to support the range, which is a very good sign.

2024 could be a great year for Stanley Black & Decker

The year 2023 therefore looks set to be the lowest point in profits, which is worth noting. But the real takeaway likely lies in the improvement that will occur in 2024, if management can achieve the targeted adjusted earnings range. Assuming the company can earn $1.40 per share in 2023, the high end of the projected range, adjusted earnings will increase 285% in 2024 if it only hits the low end of expectations ($4.00 ). The high end – $5.00 – would result in a 350% increase in adjusted profit. Wall Street will likely change its view of Stanley Black & Decker in a very positive way if any of these scenarios play out.

Should you invest $1,000 in Stanley Black & Decker right now?

Before buying Stanley Black & Decker stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Stanley Black & Decker was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor The service has more than tripled the performance of the S&P 500 since 2002*.

*Stock Advisor returns December 18, 2023

Ruben Gregg Brewer holds positions at Stanley Black & Decker. The Motley Fool has no position in any of the securities mentioned. The Motley Fool has a disclosure policy.

This dividend king is poised for a big rebound in 2024 was originally published by The Motley Fool