Markets have been in a correction phase since the Sensex and Nifty hit their all-time highs on September 26.

The market’s exuberance following Donald Trump’s victory lasted only one day, and it turned red again on Thursday and Friday.

REIT capital outflows and concerns about slowing earnings have reinforced the markets’ downtrend.

An analysis of the market correction since September 26 shows that the fall has been widespread, with 7 out of 10 stocks in the BSE Allcap index generating negative returns during this correction phase.

Here’s another look at fall:

Resilient mid and small caps

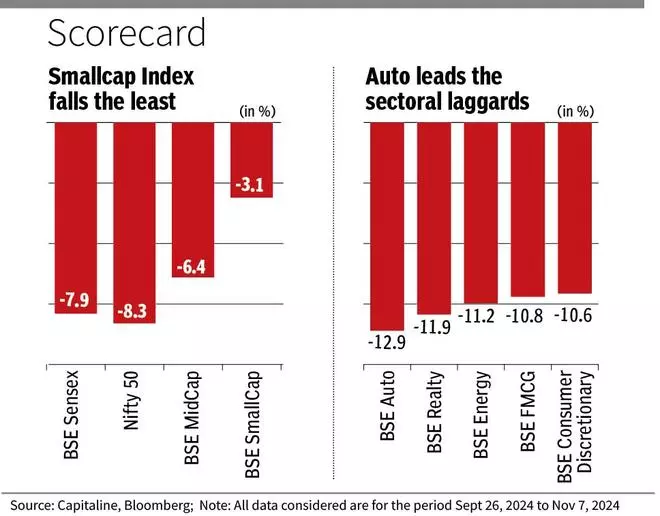

Nifty and Sensex corrected 8.3 percent and 7.9 percent respectively from all-time highs.

However, the mid-cap and small-cap indices have fared better, with the BSE MidCap and BSE SmallCap losing only 6.4 per cent and 3.1 per cent, respectively, since September 26.

Nine out of 10 large-cap stocks lost in this correction, while it was 8 out of 10 for mid-caps and 7 out of 10 for small-caps.

IndusInd Bank (-27.2 per cent) and Avenue Supermarts (-25.3 per cent) led the large-cap correction. L&T Finance (-22.8 per cent) and Colgate Palmolive India (-21.3 per cent) were the biggest mid-cap losers, while the small-cap downward march was led by Spandana Sphoorty Financial (- 33.5 percent) and CPCL (- 28.7 percent). This relatively less turbulent performance on the part of mid- and small-caps has, however, widened their valuation gap compared to the large-cap index. BSE Smallcap’s trailing twelve month (TTM) PE now carries a premium of 58.9 per cent to that of Sensex, up from 48.3 per cent when they were trading at all-time highs.

This same figure now stands at 43 percent for average values compared to 37.2 percent.

Automatic skids

All sectoral indices are in the red, with BSE Auto leading the list of laggards, losing 12.9 per cent, followed closely by real estate and energy.

Although rising valuations could explain the sharp corrections in the latter, automobiles, in particular, are experiencing a slowdown in demand, particularly in the photovoltaic segment.

The health care index barely fell during this correction (-0.1 percent), unaffected by the cost of raw materials or the general slowdown in consumption, which hit many others .

The outlook is unclear

India has seen galloping bulls since the Covid-19 crash. Although there were corrections along the way, investors seemed to be whispering: “Why are we falling, Bruce? to the markets, while buying at each drop.

With high valuations, global risks and fears of slowing profits, could things be different today? Only time will tell.