While markets have generated double-digit returns over the past two Diwali years, it remains to be seen whether there will be a hat-trick. Samvat 2080 had it all. It was marked by real conflict in the Middle East, by an electoral frenzy in India and by a drastic reduction in interest rates by the American Fed.

And, despite the turbulence that preceded Samvat 2081, the year that has just passed has been an extraordinary year in more than one way. The Nifty and Sensex have risen 24.7 per cent and 22.5 per cent respectively since last Diwali, with the indicators hitting all-time highs before retreating. More importantly, the recovery has spread to broader markets. Three out of four stocks in the BSE Allcap universe posted gains during this period.

More success in large caps

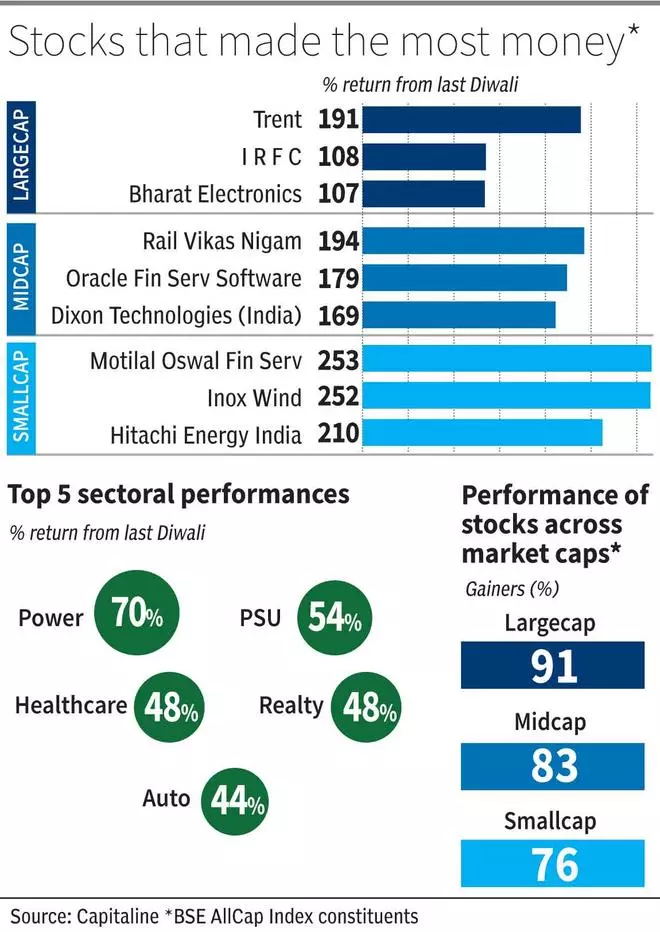

BSE Midcap (up 41 percent) and BSE Smallcap (up 39 percent) were again the big winners at Samvat 2080, as was the case during Samvat 2079. BSE Large-cap recorded gains of 27 percent. While the returns of the large-cap index look lackluster compared to their mid- and small-cap counterparts, stocks have recorded the highest success rate, with 9 out of 10 stocks posting positive returns during Samvat 2080 .

Trent led the large-cap field with returns of 191 per cent, while IRFC, Bharat Electronics, Hindustan Aeronautics, Siemens and Zomato also made their way into the multi-bagger list with returns of 100-110 per cent. hundred. Mid- and small-caps saw a slightly lower success rate, around 83 percent and 76 percent, respectively.

Rail Vikas Nigam topped the midcaps with an equally impressive return of 194 percent, followed by Oracle Financial Service Software and Dixon Technologies India with around 170 percent. Among the three market capitalization segments, small-cap stocks recorded the highest individual returns, with Motilal Oswal Financial Services and Inox Wind rewarding investors with a solid return of 250 per cent.

That said, it is worth noting that approximately 1 in 7/6/5 stocks in the large/medium/small universe, respectively, that gave positive returns, saw their EPS decline (year-over-year) over the course of this period. period.

Consumer products are lagging

Tailwinds in the form of increased electricity demand and a drive to increase renewable energy capacity, backed by government support, continued to boost electricity stocks. BSE Power led the sectoral charge with returns of around 70 per cent for Samvat 2080. PSUs followed with returns of around 54 per cent, despite a 15 per cent correction from their high of 52 weeks since July 24, due to fears of dizzying gains and high valuations.

BSE Financial Services and BSE FMCG were last with returns of 21 per cent and 15 per cent, respectively. Among financial services, banks are facing slowing deposit growth and pressure on net interest margins. Concerns over asset quality in segments such as microfinance lending have resurfaced. FMCG, on the other hand, is struggling to grow its urban volumes, with the main concern being the shrinking middle class.

Darkened outlook

The lead-up to Samvat 2081 has been turbulent with the Nifty falling 5.7% in October. FIIs shifting their funds to a recovering China and slowing profit growth are the main reasons for this decline.

While markets have generated double-digit returns in the last two years of Diwali, it remains to be seen if there will be a hat-trick. A slowdown in earnings amid high investor expectations, apart from other global uncertainties, poses a major risk.