(Bloomberg) — Asian stocks fell Monday morning as traders limited expectations that the Federal Reserve will cut interest rates following new signs of U.S. economic resilience.

Most read on Bloomberg

Japanese and Australian stocks fell. South Korea’s benchmark index bucked the trend, led by Samsung Electronics Co.’s rally after announcing a share buyback plan. US futures rose after the S&P 500 fell 1.3% on Friday, erasing more than half of its post-US election gains.

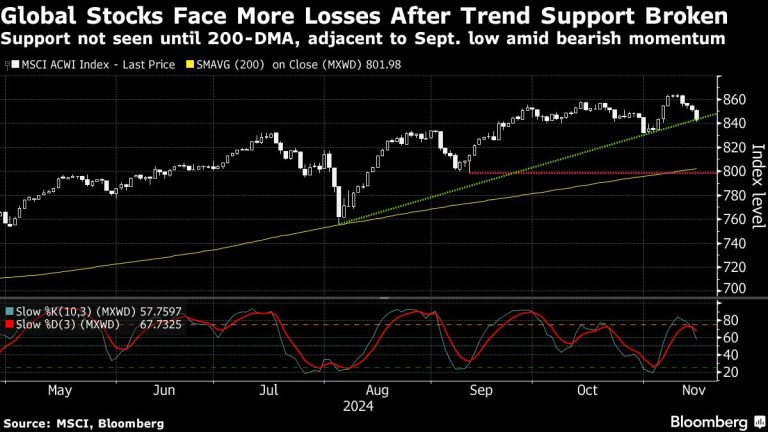

A soft start risks prolonging last week’s global selloff, as investors weigh the prospect of Donald Trump’s tariffs and tax cuts potentially reigniting inflation in an already robust U.S. economy. A report on Friday on October U.S. retail sales, which included significant upward revisions, also supported bets that the Fed could pause its easing cycle in 2025, with the chances of a decline in rates next month are now considered lower than a draw.

“Another Fed cut is still likely in December, but it is now close,” wrote Shane Oliver, chief economist at AMP Ltd. in Sydney, in a note addressed to its clients. « A slower pace of easing is likely next year, especially as Trump’s policies on tariffs and further tax cuts pose upward threats to inflation over one to three years. »

The dollar weakened slightly after climbing 1.4% last week, a seventh straight weekly gain as Treasury yields jumped on reduced expectations for Fed policy. These measures, coupled with concerns about Chinese growth, have devastated everything from the Australian dollar to emerging market bonds. Asian stocks fell 3.9% last week, their worst sell-off in about six months.

In the commodities sector, oil maintained a weekly decline on concerns over ample supply and weaker demand from top crude importer China. Ukraine’s allies are pushing Volodymyr Zelenskiy to consider new ways to end the war with Russia, as the United States mulls a final decision to lift some restrictions on Western-made weapons to strike military targets limited in Russia.

Later on Monday, traders will watch a speech and news conference from Bank of Japan Governor Kazuo Ueda for guidance on the central bank’s next policy move after officials expressed concerns regarding the rapid weakening of the yen.

“Ueda’s press conference should be the main focus this week in assessing the timing of the BoJ’s next rate hike,” Barclays strategists led by Themistoklis Fiotakis wrote in a note to clients. “USD/JPY may remain under near-term upside pressure due to Trump’s carry trades and the yen, but will likely rise more slowly as it approaches 160 due to concerns over « intervention in the foreign exchange market and positioning for faster rate increases. »